They say that hindsight is 2020. Since it is already 2021, we now have the benefit of hindsight when we look back at the year that will forever be associated with COVID. Some companies fell apart. Others flourished. Enough time has passed that we can start drawing initial conclusions about how the business world has changed since the onset of the COVID crisis. This analysis covers AVIS Budget Group, a company that managed to survive the pandemic despite COVID’s decimation of the travel industry.

WHO IS AVIS BUDGET GROUP?

If you have ever spent any time in an airport, you probably know Avis and have a general idea about what they do: car rental. Avis’s parent company, AVIS Budget Group, is headquartered in New Jersey and includes several brands that cover different niches of the car rental industry: Avis, Budget Rent a Car, Budget Truck Rental, and Zipcar (for brevity’s sake, “Avis” will hereafter refer to AVIS Budget Group). Across these businesses, they serve over 11,000 locations worldwide in 180 countries. Enterprise Holdings and Hertz Group are the company’s main competitors, and together, these three companies occupy about 94% of the United States rental car market. Their business model is fairly straightforward: Avis is a leading rental car provider to the commercial segment serving business travellers at major airports worldwide, and to leisure travellers at off-airport locations. Most of their airport locations are owned and operated by the company, whereas many of their off-airport locations are franchised operations. Based on this model, the company earned a revenue of 9.172 billion USD in 2019.

HOW DID COVID IMPACT THE COMPANY?

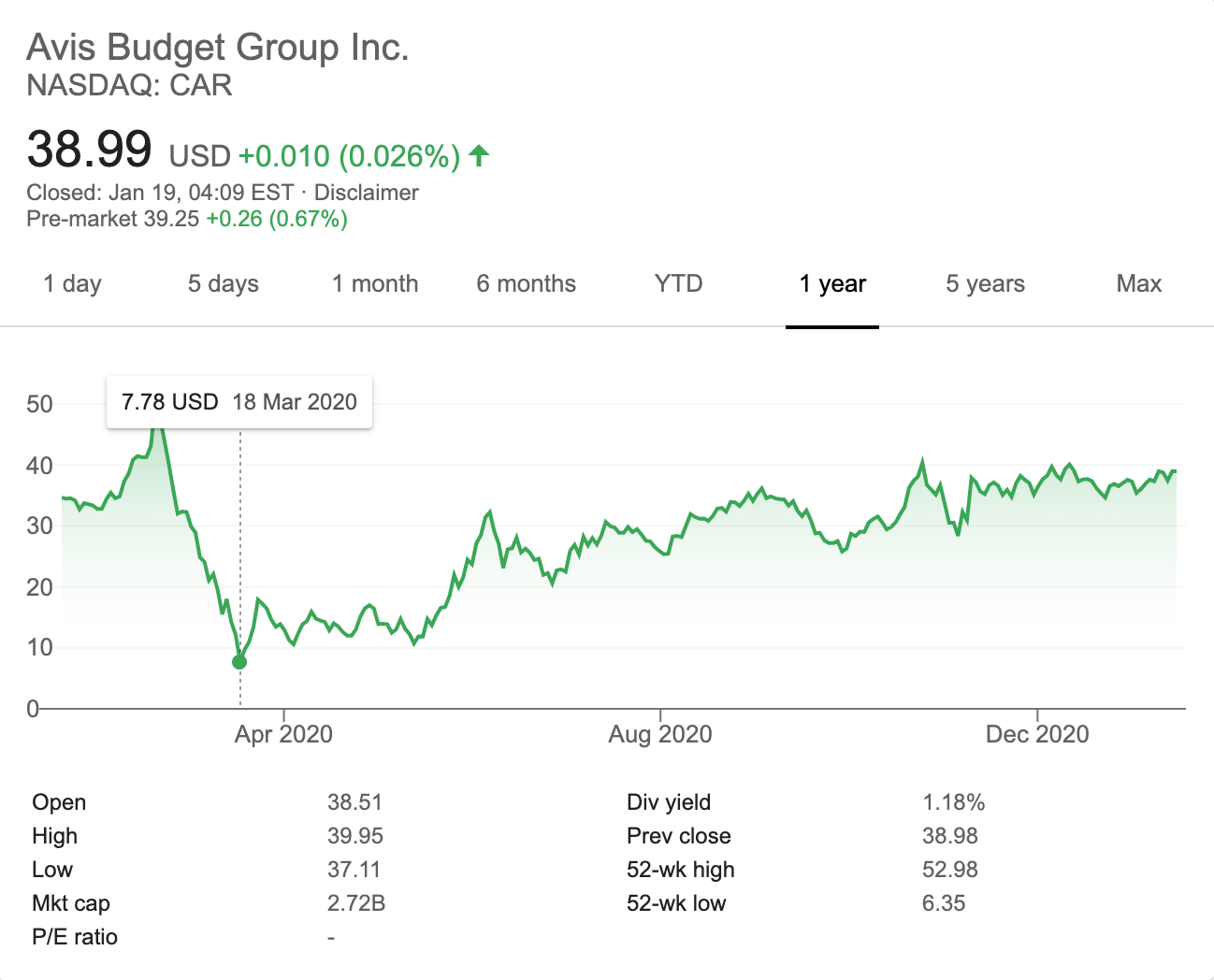

Perhaps no industry was hit harder by COVID than the travel industry. If you were lucky enough to have not needed to travel in March 2020, you avoided a nerve-wracking experience. Airlines kept cancelling flights and nations closed borders, leaving people stranded. Very quickly, the travel industry ground to a halt. Given Avis’s reliance on airports and travel in general, revenue also halted abruptly. The company reported a loss of 481 million USD in Q2 2020, with revenues falling 67% compared with the same quarter of 2019. In total, they lost 639 million USD in the first six months of 2020. The company’s stock, however, rebounded admirably and is now sitting at pre-pandemic levels. This stock performance is due in large part to the company’s strategic changes, as detailed below.

HOW DID AVIS’S STRATEGY CHANGE DURING COVID?

Depending on your industry, you may or may not be familiar with the term “rightsizing”. Due to the decrease in travel across the globe, AVIS had to adjust the size of their existing fleet. In order to “rightsize” their fleet, they profitably sold 75,000 cars in the United States during Q3, the most they ever sold in any quarter in this company’s history. This included a direct-to-consumer channel, which they continued to expand by opening large retail locations. Thus, they capitalized on a strong used car market in order to solve cashflow issues.

Avis also used another tried and true tactic to solve cashflow problems: layoffs and furloughs. Not only did the company rightsize their fleet, but they also rightsized their workforce to match demand. According to their CEO, “We’ve become a leaner and more efficient organization, which will continue to benefit our bottom line even after the impacts of this pandemic have subsided.” The company laid off or furloughed approximately 70% of its workforce— 21,000 employees—in the early part of 2020, and then extended those furloughs in the latter half.

The travel industry started to bounce back towards the summer of 2020. Once market conditions started to improve, Avis was able to leverage their prior technology investments in Demand Fleet Pricing, which maximizes the profitability of every transaction. Consumers are already fairly familiar with such pricing schemes throughout the travel industry, especially when it comes to plane tickets. Importantly, Avis expanded its use of technology to deliver contactless car rental experiences. Their Preferred customers can arrive, can select their specific car on their phone, proceed directly to their vehicle, then use a unique QR code to exit via their automated Express Exit for a completely contactless experience.

WAS THIS STRATEGIC CHANGE SUCCESSFUL?

Success has always been relative, but that was especially true in 2020. So, to determine whether Avis did well, we have to compare them to their competitors. One of Avis’s main competitors, Hertz, declared Chapter 11 Bankruptcy in May of 2020, citing COVID as one of the primary causes for its downfall. As for Avis’s other main competitor, Enterprise, we simply cannot know how they performed. They are one of America’s largest private companies, which means they are not required to disclose confidential financial performance data to regulators.

In a year that saw the travel industry decimated by the pandemic, Avis was able to stay agile enough to recover, which is admirable. Given the bankruptcy of one of its main competitors, Avis’s market position might soon be better off than it would have been had the pandemic never happened. Moreover, they have implemented changes that will serve them well for years to come. Even before the pandemic, companies across all industries were already moving full steam ahead towards automation, since it decreases human labour costs and can even improve the customer experience. We expect for Avis’s fully automated, contactless car rental experience to become the industry standard in the near future. The company will soon release its Q4 and full-year 2020 results, and we expect great things from the company in 2021 and beyond.