Parts of the current crisis feel awfully familiar, while other aspects are completely unprecedented. The level of familiarity all depends on where one looks. This series investigates five different industries around the world to show the similarities and differences between the Great Recession and the Corona Crash. While our Corona data is inherently limited, we can still draw conclusions based on Great Recession data about where it may go in the future. This week, we are examining the airline industry in the United States and Europe.

Luggage Baggage

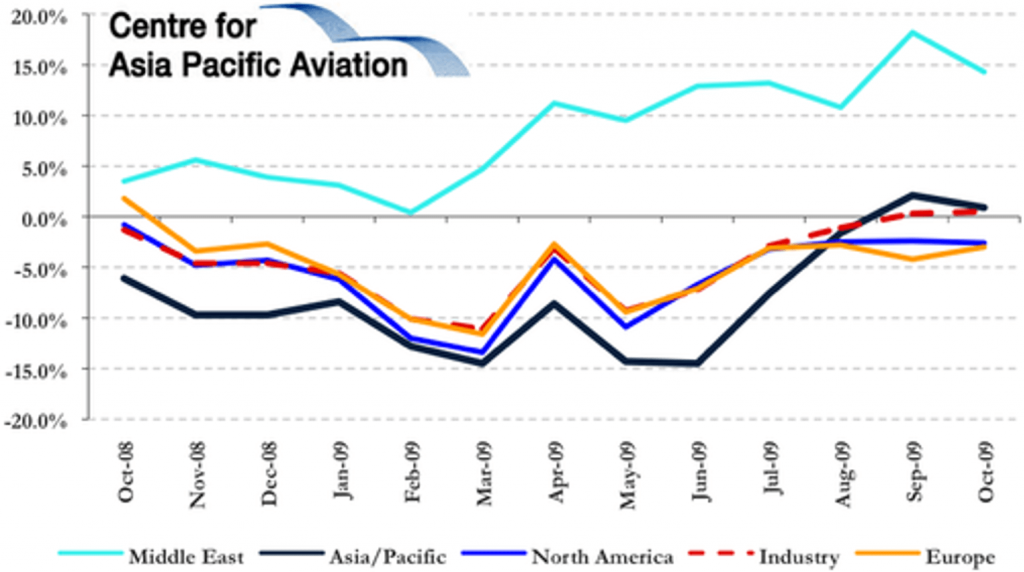

Just before the Great Recession, the drastic increase in oil prices sent long-term shockwaves through the airline industry. We explain in much greater detail in this article, but suffice it to say that the cost of oil nearly quadrupled between 2004 and 2008. While oil prices impact just about every industry, the transportation industry felt its effects worse than most. According to a report by the United States Department of Transportation, “while airlines spent only 10 per cent of their operating costs on fuel in 2001, by 2011 this had risen to 35 per cent—near the all time [sic] high of 40 per cent in 2008.”¹ When the Great Recession struck, travel across the board took a huge hit. Business travel decreased because there was far less business going on. Recreational travel also decreased substantially, since fewer people had disposable income. The following chart shows the global passenger traffic from October 2008 to October 2009.

IATA international passenger traffic (RPK) growth by region: Oct 2008 to Oct 2009

Except for the Middle East, the global airline industry suffered heavy losses after the onset of the Great Recession. At the time, these figures were considered catastrophic, but as we will show later in this article, COVID has completed redefined “suffering” and “catastrophe”. These decreases elicited three market shifts: consolidations, ancillary costs/fees, and aggressive pricing. In the United States in the year 2000, ten domestic carriers covered the vast majority of travel within the United States. By 2012, only five remained as a result of a series of mergers and acquisitions. The second and third major shifts took place on the pricing end. Carriers had to find ways to squeeze more money out of their customers without simply raising ticket prices across the board.

Many airlines started charging for things that were once considered part of the standard economy ticket price. Nowadays, we are used to paying hefty sums for our luggage, but customers were not happy when airlines implemented this policy. Airline balance sheets have also grown accustomed to, if not reliant on, these fees. As of 2019, baggage fees made up roughly 3% of the overall operating revenue for US-based airlines.² Notably, low-cost carriers are especially reliant on baggage fees. Spirit Airlines, a low-cost American carrier, earns 19% of its operating revenue from baggage fees. Ryanair, one of Europe’s leading low-cost carriers, earns 31.7% of its revenue from ancillary fees, including baggage and seat selection fees. It should be noted that this trend is not global: most full-service Asian carriers include baggage with their basic economy fares.

Finally, airlines became more aggressive when it came to adjusting ticket prices in response to fluctuations in fuel prices and demand. Before, ticket prices were far less dynamic and far more predictable. As more consumers moved to online ticket purchases, more dynamic and profitable pricing became the norm across the industry. Overall, these changes drastically affected the customer travel experience. Decreased baggage has translated into a significant reduction in flight delays and cancellations. At the same time, there has been an overall trend towards fewer short flights, thereby decreasing customer choice.

Empty Vessels

If you were to teleport someone from 2019 into 2020, perhaps the most confusing place for them to end up would be an international airport. Anybody who has travelled in 2020 can tell you why: during what was once peak travel season, airports are relative ghost towns. Most of the restaurants are shuttered, and, of course, everybody is wearing masks, even in the US. For an industry that barely turns a profit even in the best of times, the worst of times have been particularly devastating. The Transportation Security Administration of the United States counts passenger numbers for every single day. The following chart shows the per cent change in passenger counts between 2019 and 2020 in the United States.

Passenger Data Comparison, 2019 vs 2020

| Date | 2019 | 2020 | % Change |

| 1 March | 2,301,439 | 2,280,522 | -1% |

| 1 April | 2,151,626 | 136,023 | -94% |

| 1 May | 2,546,029 | 171,563 | -93% |

| 1 June | 2,499,002 | 353,261 | -86% |

| 1 July | 2,547,889 | 626,516 | -75% |

| 1 August | 2,367,967 | 709,033 | -70% |

| 1 September | 2,037,750 | 516,068 | -75% |

| 1 October | 2,447,687 | 855,908 | -65% |

| 1 November | 2,459,525 | 936,092 | -62% |

Source: https://www.tsa.gov/coronavirus/passenger-throughput

Europe has followed a very similar trajectory. According to the Airports Council International, Q3 2020 passenger traffic in Europe’s airports has fallen by 73.2%, putting it largely in line with the United States during the same period. In summary, airlines are in dire straits. When they have been put in similar situations in the past (situations that were considerably less catastrophic, like the Great Recession), they were forced to “innovate”.

Source: SAS Scandinavian Airlines, Public domain, via Wikimedia Commons

Becoming Permanent

Whenever I watch a film or TV show with an aeroplane scene, everything seems so exaggerated. The seats are huge, flight attendants serve fancy meals, and the passengers are all dressed to the nines. While I realise that I am looking through the rose-coloured lenses of both nostalgia and Hollywood, it is hard not to think about how far the industry has fallen. We have seen over and over again that airlines began to charge for what we once held for granted. Post-COVID, we expect that the “predatory” practices of the budget carriers will carry over to the mainstream airline industry. So, what was once considered taboo for major airlines, such as charging for hand luggage, will become common practice. Moreover, we are going to have to get used to a lower level of service. If you have taken a flight during COVID, you have already seen the effects: drink carts come by with less frequency, meals are mostly cold (if you receive a meal at all), and many services simply are not available. Given the situation, this is not only understandable but ideal given that airlines are attempting to protect their workforce and passengers alike. I will not be surprised, however, if this lower standard of service remains even after vaccines take care of COVID.

¹ “AVIATION INDUSTRY PERFORMANCE: A Review of the Aviation Industry, 2008–2011”. The United States Department of Transportation, 2012.

²